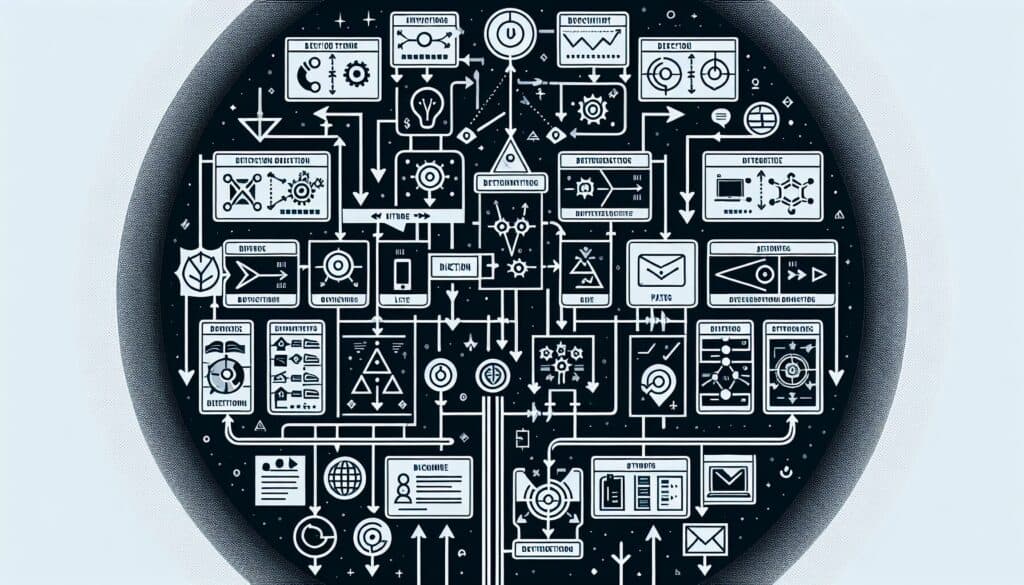

To visually map out different decision paths and their potential outcomes, helping to choose the course of action with the highest expected value or best outcome.

- Methodologies: Customers & Marketing, Economics, Product Design

Decision Tree Analysis

Decision Tree Analysis

- Multiple-Criteria Decision-Making (MCDM), Process Improvement, Quality Control, Quality Management, Risk Analysis, Risk Management, Statistical Analysis, Value Proposition

Objective:

How it’s used:

- A tree-like model is constructed where nodes represent decisions or uncertain events, branches represent possible choices or outcomes, and leaves represent final outcomes with associated values or probabilities.

Pros

- Provides a clear and logical framework for decision-making; allows for the incorporation of uncertainty and risk; easy to understand and communicate.

Cons

- Can become very complex with many decision points and outcomes; relies on accurate estimates of probabilities and values; can be sensitive to small changes in input data.

Categories:

- Economics, Problem Solving, Project Management

Best for:

- Making complex decisions under uncertainty by evaluating various choices and their potential consequences.

Decision Tree Analysis is utilized in various domains such as healthcare, finance, product development, and risk management, where decision-makers often face uncertainty regarding outcomes. In healthcare, for instance, it can aid in evaluating treatment options by modeling the potential success rates and associated costs or side effects, allowing practitioners to choose the best course of action for patient care. In finance, investment analysts employ this methodology to assess the viability of different strategies by weighing potential returns against associated risks, which is particularly salient in volatile markets. The project phase during which Decision Tree Analysis is most effective typically involves initial planning or evaluation, where stakeholders gather to identify available options and their probabilities before moving forward. This collaborative approach often includes product designers, engineers, business analysts, and decision-makers who bring diverse expertise to the table, thereby enriching the analysis. A significant advantage of this methodology is its ability to visually represent decisions, making it easier for participants to comprehend the implications of different choices and fostering consensus among team members. Furthermore, the ability to incorporate probabilistic outcomes allows for a more nuanced understanding of risk, which is invaluable when making decisions that require balancing various factors, such as cost, time, and quality. Implementing this methodology can thus lead to more informed, transparent, and effective decision-making processes across different industries and project stages.

Key steps of this methodology

- Define the decision problem and objectives clearly.

- Identify all possible alternatives for decision-making.

- Determine the uncertain events that could impact outcomes.

- Assign probabilities to each uncertain event and outcome.

- Estimate the values or payoffs for each final outcome.

- Construct the decision tree with nodes, branches, and leaves.

- Calculate the expected monetary value for each decision path.

- Analyze the results and select the optimal decision path.

- Assess sensitivity to changes in probabilities or values.

Pro Tips

- Utilize sensitivity analysis to assess how changes in probabilities or outcomes affect overall decision value, allowing for identification of critical risk factors.

- Incorporate Monte Carlo simulations to quantify uncertainty in scenarios where probabilities are not easily defined, enhancing the robustness of the decision model.

- Periodically review and update the decision tree as new data becomes available, ensuring that the model remains relevant and reflective of current conditions and uncertainties.

To read and compare several methodologies, we recommend the

> Extensive Methodologies Repository <

together with the 400+ other methodologies.

Your comments on this methodology or additional info are welcome on the comment section below ↓ , so as any engineering-related ideas or links.

Historical Context

1828

1850

1854

1854

1911

1928

1950

1827

1848

1850

1854

1895

1914

1943

1970

(if date is unknown or not relevant, e.g. "fluid mechanics", a rounded estimation of its notable emergence is provided)

Related Posts

Musculoskeletal Discomfort Questionnaires

Multivariate Testing (MVT)

Multiple Regression Analysis

Motion Capture Systems

MoSCoW Method

Mood’s Median Test